Why Investing in Fine Wine Is the New Smart Asset Class

When it comes to building long-term wealth with real-world prestige, investing in fine wine has become the tasteful alternative asset of choice. In a world overrun by speculative digital trends and market volatility, fine wine offers a stable, tangible investment that marries culture, scarcity, and performance.

With consistent historical returns between 8% and 12% annually, wine has proven its value over the decades. Unlike cryptocurrencies or NFTs, a bottle of Domaine de la Romanée-Conti or Château Lafite Rothschild retains intrinsic value—and often increases in value over time. Whether you’re a high-net-worth individual, luxury enthusiast, or a savvy investor, fine wine investment offers the perfect blend of emotional satisfaction and financial growth.

Top Benefits of Wine Investment

Portfolio Diversification with Low Market Correlation

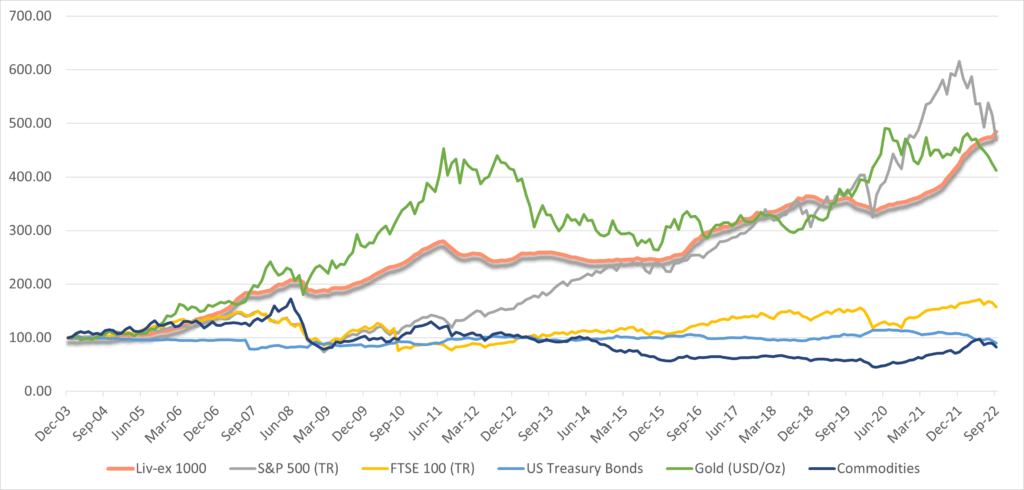

Wine is an uncorrelated asset, meaning it rarely follows the fluctuations of the stock market. This makes it an ideal hedge during periods of economic instability or inflation. When stocks dip, fine wine often holds or even grows in value.

Historical Returns and Capital Appreciation

Image by Cult Wine Investment*

Since 1988, fine wine has shown an average annual return of 10% on premier labels. These returns stem from its limited supply, growing global demand, and the natural scarcity created as bottles are consumed over time.

Tangible, Prestige-Driven Asset

Unlike digital investments, wine is something you can physically touch, store, admire, and even enjoy. It’s the perfect luxury investment for those who value art, history, and exclusivity.

Supply Scarcity Meets Global Demand

Fine wine is produced in limited quantities and cannot be reproduced. As wealth rises in Asia, the Middle East, and the U.S., so does demand, especially for iconic regions like Bordeaux, Burgundy, and Champagne.

Inflation-Resistant and Crisis-Proof

In times of economic stress, hard assets such as gold and fine wine tend to perform best. Wine’s performance during the 2008 crash and the COVID-19 pandemic shows that it is not only resilient but also thrives when traditional assets falter.

The Liv-ex Fine Wine 1000 Index

The Liv-ex Fine Wine 1000 Index is a trusted global benchmark that tracks the price movements of 1,000 of the world’s most traded and investment-worthy wines. Comprising seven regional sub-indices—including Bordeaux, Burgundy, Champagne, and Italy—it offers a comprehensive view of the fine wine market. Calculated monthly using verified Mid Prices from real trades, not just advertised listings, the index provides transparency and reliability for investors. Whether you’re assessing portfolio performance or identifying regional trends, the Liv-ex 1000 is a vital tool for serious wine investors seeking data-driven insights and market clarity.

How Wine Investment Works

Direct Ownership: Physical Bottles & Professional Storage

Buy entire bottles or cases, store them in bonded warehouses with temperature control and insurance. Ideal for serious collectors targeting high-growth labels like Château Mouton Rothschild or Sassicaia.

Wine Investment Platforms: Cult Wines, Vinovest & More

Platforms like Cult Wines, Vinovest, and Vindome offer managed portfolios and fractional wine ownership, lowering entry barriers while maximizing returns.

Wine-Backed NFTs & Blockchain Authentication

The wine world is entering the digital era. Platforms now offer NFT-backed ownership certificates, enhancing transparency and facilitating more efficient secondary trading.

What Makes a Wine Investment-Grade?

Quality Scores & Aging Potential

Invest only in wines that score 95 or higher by critics such as Robert Parker or Wine Spectator. These bottles age gracefully, gaining complexity and value.

Provenance & Authenticity

Ensure your wine has a verified origin and storage history. Counterfeit wine poses a significant risk, particularly in rare vintages.

Liquidity and Market Demand

Top wines, such as DRC La Tâche or Penfolds Grange, are frequently traded on global platforms like Liv-ex, making them easier to sell when the time is right.

Risk Factors in Wine Investment

Fraud and Counterfeits

Fake bottles plague the market. Always buy from reputable merchants, use certified platforms, and demand full provenance.

Storage Issues

Improper storage kills value. Utilize professional, climate-controlled facilities and refrain from storing investment wine at home.

Illiquidity and Niche Risks

Obscure wines may lack buyers. Stick to investment-grade labels that have verified historical performance and a proven market presence.

Market Timing Mistakes

Avoid buying during hype peaks. The best time to enter is during price corrections, such as Burgundy’s recent 12% dip in 2024.

Top 25 Wines to Invest in (2025 Edition)

🇫🇷 Bordeaux

- Château Lafite Rothschild

- Château Latour

- Château Mouton Rothschild

- Château Haut-Brion

- Château Pétrus

- Château Cheval Blanc

- Château Ausone

- Château Cos d’Estournel

- Château Léoville Las Cases

🇫🇷 Burgundy

- Domaine de la Romanée‑Conti (La Romanée‑Conti, La Tâche, Richebourg)

- Domaine Leroy Musigny

🇺🇸 USA

- Harlan Estate

- Sine Qua Non Syrah

🇦🇺 Australia

- Penfolds Grange

- Henschke Hill of Grace

- Rockford Basket Press

- Giaconda Chardonnay

🇮🇹 Italy

- Sassicaia

- Tignanello

- Solaia

- Bruno Giacosa Barolo Riserva

- Gaja Barbaresco

🇫🇷 Champagne

- Dom Pérignon Vintage

- Salon Le Mesnil

Best Timing Opportunities in 2025

With a recent 12% correction in Burgundy and Champagne, 2025 presents a rare buying window. Tuscany and Champagne markets are already rebounding, supported by Liv-ex trading volume increases (+31.6% YoY) and value surges (+6.3%).

Savvy investors are entering now, before prices accelerate further.

How to Build a Fine Wine Portfolio

Allocate Strategically

Dedicate 10–15% of your alternative investments to wine. Begin with any budget of $500–$5,000,000, depending on your goals.

Pick the Best Vintages

Focus on collectible vintages:

2000, 2005, 2009, 2010, 2015, 2019, and 2020. Each vintage has a unique balance of longevity and prestige.

Diversify by Region and Type

Mix Bordeaux, Burgundy, Tuscany, Champagne, and Napa Valley wines. Include both red and white wines, as well as some high-value sparkling wines.

Use Professional Wine Platforms

Platforms like Cult Wines, Vinovest, and WineCap offer expert management, fraud protection, and access to top auctions.

FAQs About Wine Investment

1. Is wine a better investment than gold or crypto?

For long-term stability, wine often outperforms gold. It lacks the extreme volatility of crypto and is backed by real, tangible value.

2. How do I store wine for investment?

Utilize bonded warehouses equipped with temperature and humidity control, insurance, and tax-free status (such as Octavian or London City Bond).

3. What are the tax implications of wine investment?

In many regions, wine is considered a wasting asset, often exempt from capital gains tax. Check your local tax laws for clarity.

4. How long should I wait before selling wine?

Hold for 5–10 years. Premium wines appreciate most after aging, but still offer mid-term growth potential.

5. Can I drink investment wine if I want to?

Absolutely—but remember, drinking reduces the value of your inventory. It’s best to hold and sell unless you’re celebrating a significant milestone.

6. What happens if the market crashes?

Wine markets are slower-moving and less reactive to panic, making them more resilient to fluctuations. Prices tend to stabilize rather than collapse.

7. What is the Liv-ex Fine Wine 1000 Index?

The Liv-ex Fine Wine 1000 Index tracks prices of 1,000 top-traded wines globally. It helps investors monitor market trends and evaluate portfolio performance.

Investing in Fine Wine: A Tasteful Way to Build Wealth

Wine isn’t just an indulgence—it’s an asset. By investing in fine wine, you’re buying into heritage, scarcity, and consistent financial growth. Whether you’re drawn by performance, prestige, or personal passion, fine wine investment with Elysium987 is a sophisticated path to elegant diversification.